Your home could be the key to your next investment.

Before tapping into your equity, take a step back and consider the bigger picture:

How stable is your income if rates rise?

Will your investment returns outpace your borrowing costs?

Do you need flexibility or long-term predictability?

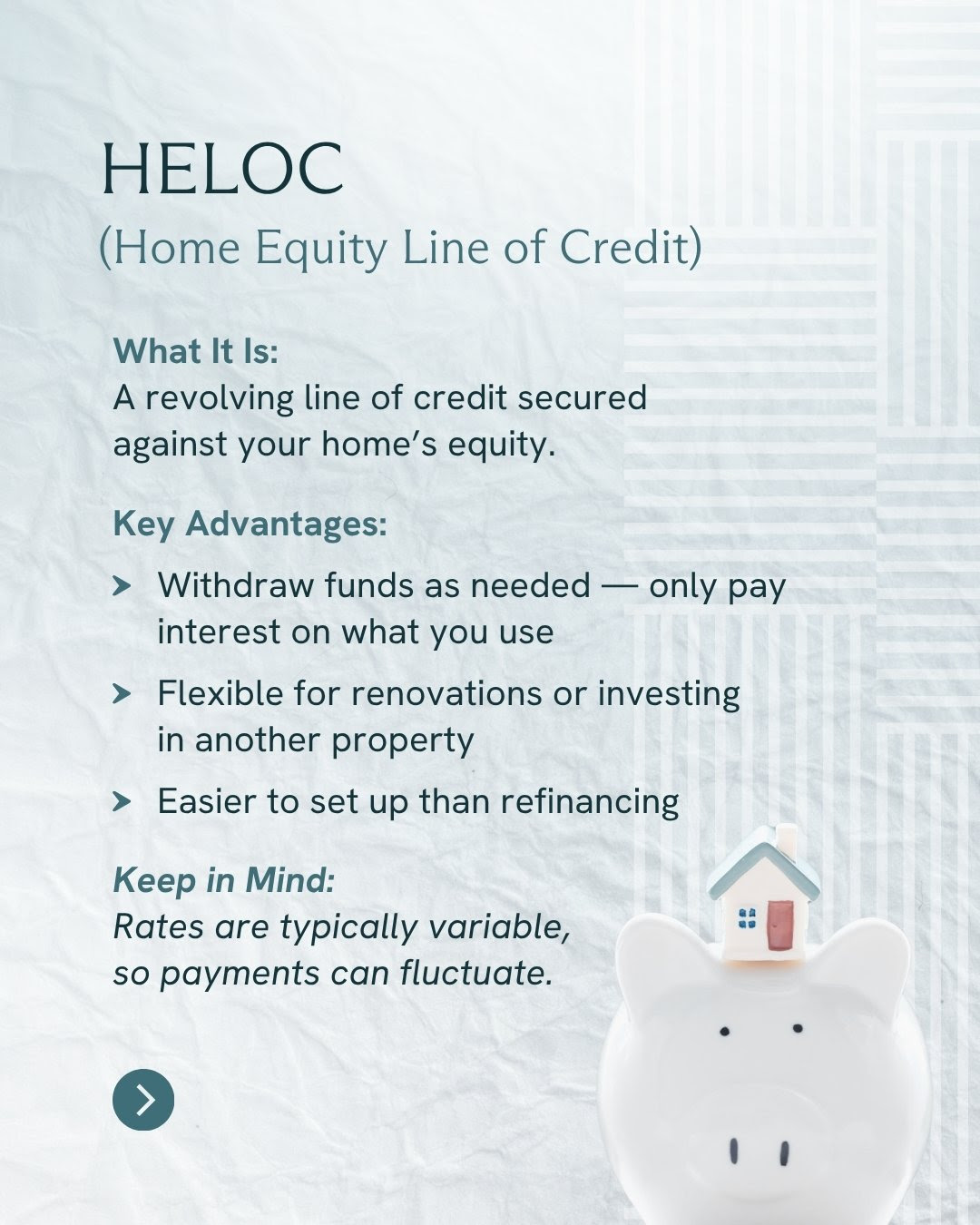

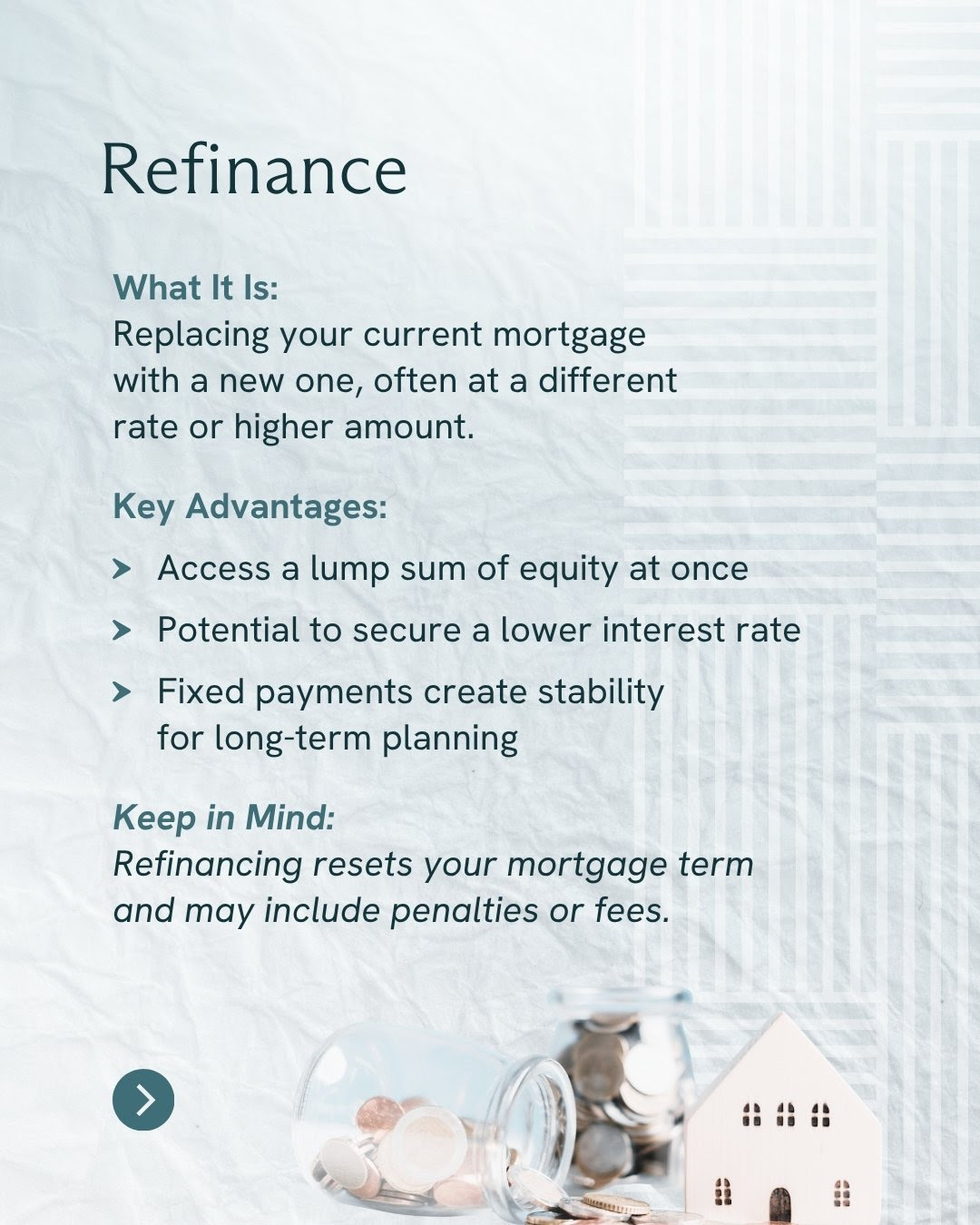

Both HELOCs and refinancing can unlock powerful opportunities — but each comes with different timelines, risks, and advantages.

A strong plan starts with understanding how these options affect your cash flow and borrowing power. The right choice depends on your long-term goals, interest rate, and how you plan to use the funds.

Ready to make your equity work for you? Reach out today to start mapping out your options and get connected to the right professionals for your next investment move.